Tokenization Era of Fundraising, a Milestone in US Regulatory Financing

The hot topic this week is that Monad will conduct an ICO on Coinbase. In addition to discussing whether the sale at a $25 billion FDV is worth participating in, as Coinbase's first ICO, its "compliance level" has also sparked widespread discussion, seen as a landmark event in the cryptocurrency industry's compliance.

Stablecoin USDC issuer Circle mentioned in its recent third-quarter financial report that it is exploring the possibility of issuing a native token on the Arc Network. Coinbase also, almost 2 years later, in an interview in October this year by Jesse Pollak, co-founder of Basechain, said that it will launch the Base token. All signs indicate that the asset issuance in the cryptocurrency industry is entering a new era of compliance.

Coinbase's Historic First ICO, What Did Monad Disclose?

For this historic first ICO on Coinbase, the Monad Foundation subsidiary MF Services (BVI), Ltd. provided an 18-page disclosure document. This document clarifies Monad's legal structure, financing details, and liquidity plan, and includes an 8-page investment risk disclosure. Compared to past ICOs, this is unprecedented and of significant progress.

At the legal structure level, Monad clarified the following:

- The seller of Monad tokens is MF Services (BVI) Ltd., a subsidiary of the Monad Foundation, with the Monad Foundation as the sole director of that company

- Monad's three co-founders are Keone Hon, James Hunsaker, and Eunice Giarta. Monad's key contributors are the Monad Foundation and Category Labs.

- Category Labs, based in New York, is responsible for Monad's technical development, with James Hunsaker serving as the CEO of Category Labs

- The Monad Foundation is a memberless foundation based in the Cayman Islands, responsible for community engagement, business development, developer and user education, and marketing services. Keone Hon and Eunice Giarta are co-managers of the Foundation. The Foundation is overseen by a board of directors including Petrus Basson, Keone Hon, and Marc Piano

These legal framework-level disclosure details provide investors with a stronger protection mechanism, enhancing investor accountability and legal recourse.

At the funding details level, Monad has clarified the following:

- Pre-Seed Funding: A funding amount of $19.6 million, conducted between June and December 2022

- Seed Round Funding: A funding amount of $22.6 million, conducted between January and March 2024

- Series A Funding: A funding amount of $220.5 million, conducted between March and August 2024

- In 2024, the Monad Foundation received a $90 million donation from Category Labs to cover operational costs before the public launch of the Monad Network. This donation is intended to cover the expected expenses of the Monad Foundation until 2026 and is part of the $262 million raised by Monad Labs in its various funding rounds

The disclosure of funding details avoids the funding fabrication and resulting misvaluation often seen in past projects in the crypto space.

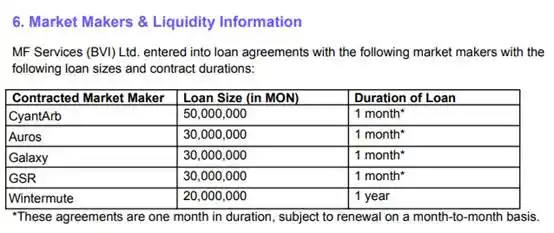

At the market making scheme level, Monad has clarified the following:

- MF Services (BVI) Ltd. has signed loan agreements with five market makers, CyantArb, Auros, Galaxy, GSR, Wintermute, lending a total of 160 million MON tokens. Wintermute has a lending period of one year, while the rest are for one month and renewable monthly

- Monitored by a third-party expert (Coinwatch) to verify the usage of lent tokens, including the idle balances of CyantArb, Auros, Galaxy, and GSR

- MF Services (BVI) Ltd. can also deploy up to an initial 0.20% of the total initial MON token supply in one or more decentralized exchange (DEX) pools

- The tokens in the market maker loans and initial liquidity are included in the ecosystem development allocation of the tokenomics

This is the first time seeing a crypto project transparently disclose specific market making schemes before the TGE. Combining all the above information, it is also the first time we have seen ICO transparency in the crypto space aligning closer to traditional market asset issuance.

The Challenging Journey of ICO Compliance

In 2017, Ethereum emerged, and the ERC-20 standard brought about the ICO frenzy, leading to a surge in projects and the industry's first boom. However, it was also in that year, July 2017, that the SEC first released guidance on ICOs. At that time, the SEC announced that any sale of a new cryptocurrency to investors with profit expectations, conducted by a centralized company, would be considered a security and must therefore comply with securities regulations.

According to this guidance, ICOs taking place in the United States after this time were likely to violate securities regulations and faced the risk of SEC prosecution. Since the publication of the guidance, there have been multiple cases brought to light. According to the SEC's 2018 annual report, in just that year, there were dozens of investigations launched involving ICOs and digital assets, "many of which remained ongoing at the close of the 2018 fiscal year."

In November 2018, the SEC issued its first civil penalties for ICOs conducted without proper securities registration. The projects Paragon (PRG) and Airfox (AIR) were fined $250,000 each and were also required to register their tokens as securities and file periodic reports.

In June 2019, Canadian social media company Kik Interactive found itself entangled in a lawsuit with the SEC due to its ICO. To fight the SEC, Kik even established a new fund called crypto.org to raise enough funds for their legal defense.

The two largest ICOs in crypto history, EOS with $4.2 billion and Telegram with $1.7 billion, were both caught up in legal disputes with the SEC. Block.one paid a $24 million fine to settle with the SEC, while Telegram reached a $1.24 billion settlement regarding the issuance of its Gram tokens under its subsidiary TON Issuer. The $1.24 billion Telegram settlement includes $1.22 billion in ill-gotten gains and a $18.5 million civil penalty.

Celebrities and KOLs have also been sued by the SEC for alleged ICO-related issues. John McAfee, the founder of the popular antivirus software McAfee, was sued for failing to disclose income he received for promoting ICO tokens, and crypto KOL Ian Balina was sued for participating in the promotion of unregistered cryptocurrency ICOs.

On July 10, 2019, the SEC approved the secondary market offering of blockchain company Blockstack PBC, marking the first SEC-qualified offering (ICO) under securities law. Another project, Props, also received approval from the U.S. Securities and Exchange Commission (SEC) in July of that year. However, two years later, Props announced plans to cease further issuance of its Props token after December 2021 based on the SEC's Reg A+ and to discontinue support for the Props Loyalty program. Props stated at the time that they had determined they could not sustain or further develop the Props Loyalty program within the existing securities regulatory framework due to a lack of relevant authorized domestic trading venues such as Alternative Trading Systems (ATS), restricting American holders of Props tokens from trading them. Similar factors hindered the development of Props.

For a long time, the ICO model has been plagued by compliance issues, so it has gradually been replaced by VC investments, exchange IEOs, and retroactive airdrops after the 2017 frenzy. Therefore, Coinbase's reintroduction of ICOs this time is not regarded by the market as a simple "nostalgic" move, but as a "rebirth" of ICOs in a whole new market structure after years of cryptocurrency compliance advancement.

The Rebirth of ICOs

On November 12, Matt Hougan, Chief Investment Officer of Bitwise, stated that Coinbase's newly launched Launchpad marks the strong return of crypto-based capital formation. Compliant ICOs are expected to become a core theme in 2026 and reshape the startup financing model to become the fourth pillar disrupting traditional finance with cryptocurrency. The previous three pillars were Bitcoin's reshaping of gold, stablecoins' reshaping of the dollar, and tokenization's reshaping of trading and settlement.

Matt Hougan stated that early ICO experiments proved that blockchain technology could connect entrepreneurs and investors faster and at a lower cost than traditional IPOs, even though the previous hype failed. The key difference this time lies in regulation and structure. Current SEC Chairman Paul Atkins (who previously co-chaired the Token Alliance, a crypto advocacy group supporting ICOs, and served on the board of tokenization company Securitize) recently called for new rules and safe harbor mechanisms to support compliant token issuance, and Coinbase's new platform is the first major practical step in this direction.

By 2025, ICOs had accounted for about one-fifth of all token sale transaction volume, a significant increase from almost negligible two years ago. Platforms such as Echo, Kraken Launch, and Buidlpad have made significant progress in all aspects compared to the past rough ICO processes or simple gas wars by adapting to current compliance requirements, incorporating features such as self-custody, multi-chain issuance support, and access control mechanisms. Successful cases like Plasma and Falcon Finance have already been seen on these platforms.

The rebirth of ICOs is a manifestation of the cryptocurrency market's flowering after years of compliance exploration. We will see more serious ICO cases like Monad, and retail investors will receive better protection. As mentioned at the beginning of the article, projects like Arc from Circle and Base from Coinbase, previously widely believed to have a low probability of issuing coins, are sending new signals in the current era of maturity in compliance.

We are entering a new era.

You may also like

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

HYLQ Strategy Invests in Hyperliquid Quantum Solutions Pioneer qLABS, Acquires 18,333,334 qONE Tokens

Key Takeaways HYLQ Strategy Corp has made a strategic investment in qLABS, purchasing over 18 million qONE tokens…

WLFI Crypto Surges Toward $0.12 as Whale Purchase Precedes Trump-Linked Forum

Key Takeaways Whale accumulation has spurred a rally in WLFI crypto prices, reaching towards $0.12 ahead of a…

Cathie Wood Reverses Path with $6.9 Million Purchase in Coinbase Stock – Is ARK Strategizing a Rebound?

Key Takeaways ARK Invest acquires 41,453 shares of Coinbase, showing renewed interest post recent divestment. This acquisition by…

Crypto Lobby Establishes Working Group to Advocate for Prediction Market Regulatory Clarity

Key Takeaways The Digital Chamber announced the Prediction Markets Working Group to promote federal oversight of prediction markets.…

Peter Thiel Discreetly Withdraws from Ethereum Treasury Venture ETHZilla – A Cautionary Note for the DAT Model?

Key Takeaways Peter Thiel and Founders Fund have completely exited their position in ETHZilla. Thiel’s withdrawal raises questions…

Coin Center Advocates Protecting Crypto Developer Liability

Key Takeaways Coin Center is actively lobbying the U.S. Senate to safeguard crypto developer liability protections. The ongoing…

$150B in US Tax Refunds Could Catalyze Fresh Crypto Inflows, Historical Trends Indicate

Key Takeaways The IRS anticipates distributing approximately $150 billion in tax refunds to U.S. consumers by the end…

Oracle Error Leads DeFi Lender Moonwell to $1.8 Million in Bad Debt

Key Takeaways A critical oracle pricing glitch caused Moonwell to incur nearly $1.8 million in bad debt. The…

Crypto Price Prediction Today 18 February – XRP, Solana, Dogecoin

Key Takeaways XRP targets a $5 move, driven by its role as an alternative to SWIFT for cross-border…

China’s DeepSeek AI Predicts the Price of XRP, PEPE, and Shiba Inu By the End of 2026

Key Takeaways DeepSeek AI suggests significant potential price increases for XRP, PEPE, and Shiba Inu by 2026. XRP…

XRP Battles Key Support Amid Grayscale Sentiment Surge

Key Takeaways XRP has experienced a 29% price drop recently, creating a tense atmosphere among traders eyeing key…

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…