Cryptocurrency "No Man's Land": The Cyclical Signal Has Emerged, But Most Are Unaware

Original Article Title: The Forgotten Phase: Why the Crypto Market Might Be Stuck Between Cycles

Original Article Author: Christina Comben, The Coin Republic

Original Article Translation: Bitpush News

Key Points:

· The cryptocurrency market may be neither in a bull market nor a bear market, but rather in a "forgotten mid-cycle phase," similar to the period of calm after the end of quantitative tightening in 2019, which often foreshadows the beginning of a new uptrend.

· The Fed's policy of ending quantitative tightening, along with similar market risk sentiment levels, indicate that the crypto market is in a consolidation phase rather than a pre-crash signal.

· Despite short-term fluctuations, crypto-friendly regulatory policies, the introduction of ETFs, and large-scale institutional adoption have made the market foundation in 2025 much stronger than in 2019.

Market Status: An Undefined State

"Is it a bull market or a bear market now?" — This question, which the crypto market is most keen on discussing, may no longer be relevant by the end of 2025. As traders and analysts attempt to label the current market, they find that this market refuses to be easily defined.

The crypto prices have failed to replicate the parabolic rise of 2021, but they have also not reached the true despair of a bear market. So, what exactly is happening?

Crypto trader Dan Gambardello offers an interpretation: we may be in the "forgotten chapter" of the cycle.

This period of calm is reminiscent of the period from July to September 2019: when the market was in a consolidation phase, the Fed ended quantitative tightening, and the crypto market seemed to be in a strange lull before the next big move.

The Ghost of 2019

Looking back at the crypto news in July 2019: the Fed officially announced the end of quantitative tightening, a policy shift that marked a subtle yet significant change in global liquidity.

A few months later in September, the tightening policy came to a full stop. This conveniently paved the way for a subsequent mild uptrend, ultimately triggering the market explosion in 2020-2021.

Today, history seems to be repeating itself. The Federal Reserve has once again announced plans to end quantitative tightening in December 2025. During both of these periods, macro liquidity has started to shift, but market confidence in crypto prices has not caught up.

"The news of the end of quantitative tightening has just been announced," Gambardello stated in a video, "This is neither the peak of a bull market nor the bottom of a bear market but a blurry zone in between."

This "middle state" is often overlooked in crypto news but is actually a key stage of the cycle reset. In 2019, Bitcoin's risk score hovered around 42, very similar to the current 43. Despite different prices, market sentiment is showing a similar level of uncertainty.

Crypto Market Risk Indicators and the Value of Patience

"If you believe the end of QT will bring a liquidity boost, consider gradually building positions on any pullbacks before December 2025," Gambardello advised.

His AI-driven system named "Zero" suggests deploying funds rationally, identifying risk areas instead of chasing market momentum.

He pointed out that Ethereum's risk model score was 11 in 2019 and is now 44. Cardano's score is 29. These numbers based on volatility and sentiment data help macro investors plan their positions rather than emotionally trading the swings.

If the score falls into the 30 or 20 range, it could present an accumulation opportunity that long-term holders dream of.

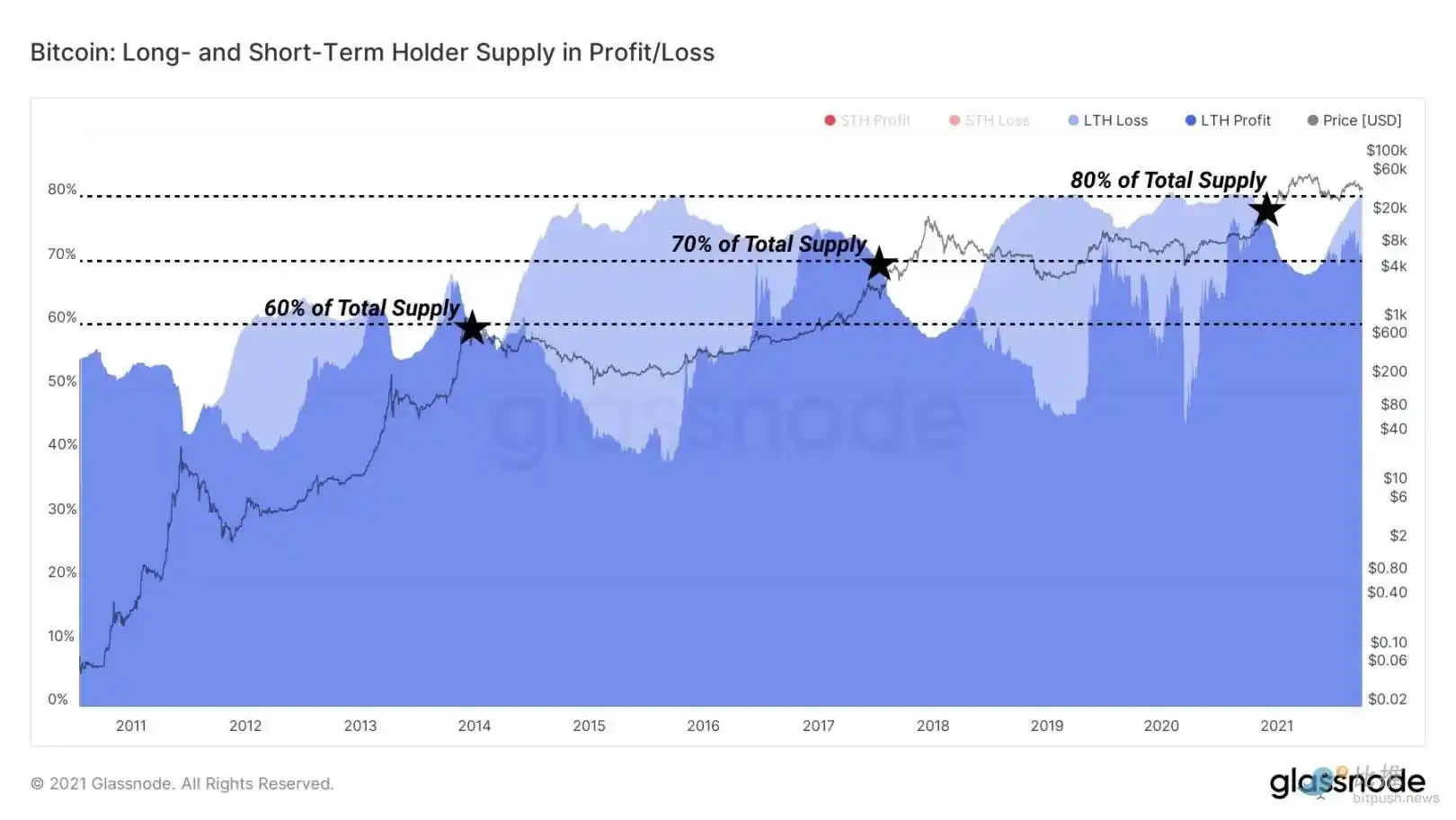

Glassnode data supports this pattern. During mid-term consolidation periods, the supply held by long-term holders typically grows as speculative traders exit.

In 2019, Bitcoin long-term holders accounted for over 644% of the circulating supply; in 2025, this number is once again approaching a similar level. Patience seems to be the secret weapon of calm investors.

Chart Source: studio.glassnode.com

What the Chart Reveals

On the Ethereum weekly chart, the trend shows striking similarity. In July 2019, shortly after the end of QT, Ethereum tested its 20-week moving average, bounced back, retested it, and only truly recovered months later.

This summer, the same 20-50 week moving average crossover is once again playing out; this serves as a reminder that the market cycle always oscillates between hope and exhaustion.

Gambardello explained that the key signal to watch for would be whether Ethereum can break above the 20-week moving average. This is a short-term confirmation signal to assess if the market is set to mirror the 2019 trajectory.

Otherwise, the total market cap temporarily dropping to the $3 trillion range (compared to the current $3.6 trillion displayed on CoinMarketCap) could replay the script from that year: a dip sufficient to scare off retail investors, yet not enough to end the upward trend.

A Different Decade, Same Market Psychology

Of course, 2025 is not a mere replication of 2019. The headlines in crypto news have changed, and there have been significant macro shifts.

A crypto-friendly U.S. government is now in power. The CLEAR Act and the GENIUS Act have essentially put an end to the regulatory uncertainty that used to keep investors up at night. Ethereum ETFs are now trading.

Stablecoin issuers are under regulation. BlackRock now sits atop the throne of $250 billion in crypto ETF assets.

This institutional force will not vanish overnight. Instead, it has altered the market's rhythm, transforming the adrenaline-fueled market into a domain managed by spreadsheets and stress tests.

What we may be witnessing is not another bull or bear market, but rather a more nuanced shift: a transitional phase within a larger monetary climate system.

The Federal Reserve's liquidity pivot, the inauguration of a new chair in May, and regulatory normalization might collectively make 2025 a period of quiet preparation before the next upswing.

Gambardello doesn't believe we are entering a bear market, but rather a "frustrating consolidation phase".

Yes, it's frustrating. But perhaps it's necessary. If the 2019 crypto market taught us anything, it's that boredom is often the prelude to a breakthrough.

You may also like

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…